Five fertilizer market dynamics that tell the story of 2022

In this blog, IFA's Market Intelligence Director, Laura Cross, explains the five key fertilizer market dynamics of 2022.

To say that 2022 was a rollercoaster year for fertilizer markets is an understatement.

The global markets for nitrogen, phosphates and potash were already in a tightened state following strong demand driven by the Covid-19-induced emphasis on food security and a series of supply interruptions and high raw material costs in 2021. At the end of 2021, IFA’s Market Intelligence published its Short-Term Fertilizer Outlook 2021-2022, forecasting that the fertilizer market would be driven by a fine balance of affordability and availability in the next two years.

Little did we know just how true this would become as a result of the events of 24th February 2022 when Russia invaded Ukraine. Since then, global supply chains have been tested by multiple challenges, there has been significant price volatility and the role of fertilizers in food security has been in the spotlight more than ever. This article highlights five key industry trends in 2022.

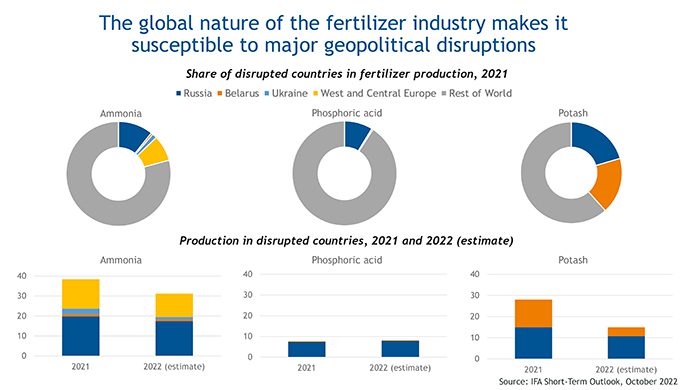

- The global nature of fertilizer supply

The fertilizer industry is truly global, with the geographic distribution of production dictated by energy economics and government policy in the case of nitrogen, and the presence of mineral deposits for phosphate and potash. The markets follow a commodity cycle based on the balance between supply and demand, and there are high levels of integration globally. In 2022, supply was disrupted in a number of countries, from Russia, Belarus and Ukraine, to Europe and China.

In the initial aftermath of the war in Ukraine, the fertilizer market faced uncertainty over the ability of Russian exports to interact with the international market, due to sanctions on Russian individuals, entities and the country’s banking sector. This was exacerbated by a lack of Belarusian potash following sanctions implemented in H2 2021, by China’s export restrictions on nitrogen and phosphate and by unprecedented natural gas price increases in Europe, impacting nitrogen production costs.

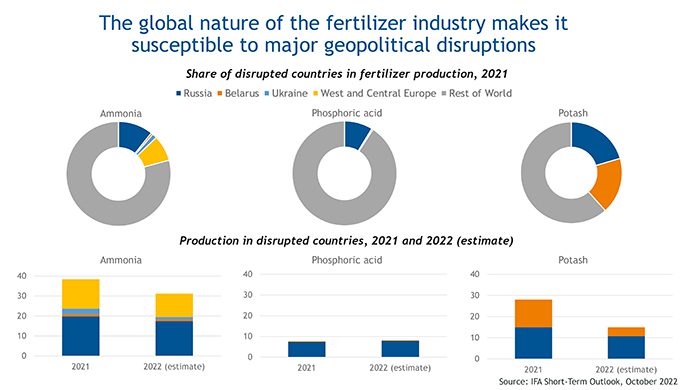

- Fertilizers sit at the intersection of energy and food

Fertilizer prices are determined by the global balance between supply and demand, underpinned by production costs. The role of production costs is usually most relevant for commodity markets during periods of oversupply, when global prices fall to the level of the highest-cost producer, also known as the floor price. Supply is rationalized through economic competitiveness to meet a finite amount of demand. In periods of the market cycle when there is more demand than available supply, prices rise to the level accepted by well leveraged buyers who exercise their purchasing power to access the limited volume of material on offer. In this situation, demand is rationalized through ability to pay, to meet a finite amount of supply.

In 2022, the market witnessed a unique combination of these two market forces, and highlighted the crucial role of energy markets on fertilizers and food supply. The nitrogen production process is energy-intensive, with 70-80% of the cost of ammonia driven by energy feedstock costs, and phosphates production also being exposed to energy-derived raw materials. The spiraling price of natural gas in Europe in 2022 has had a significant impact on the nitrogen floor price, meaning that even with supply disruptions being alleviated elsewhere, nitrogen prices have remained elevated.

- The role of fertilizers in feeding the world

The use of fertilizers has a direct correlation with crop yields and in turn on global food security. Productive agricultural systems rely on the efficient use of mineral fertilizers in order to deliver yields at levels that meet global population demands. Indeed, the world has recently witnessed a cautionary tale of the disastrous impacts of sharply turning away from mineral fertilizers in the form of Sri Lanka’s ban on mineral fertilizers in 2021. The ban was soon reversed, but still had time to have an impact on yields and GDP, with the USDA calculating a 33% reduction in rice productivity and a 35% decline in the tea crop, an important source of foreign income for the country.

It is difficult to model the global impact of reduced fertilizer application because of rapidly changing affordability decisions at the farm level, but also because of specific soil and nutrient uptake conditions, which can vary from one part of a field to another, let alone across countries, regions and the world.

Noting these challenges, IFA has contributed to an exercise attempting to quantify the impact of reduced fertilizer application on staple crop yields. The exercise focused on nitrogen, for which there is an existing pool of scientific literature with yield response curves which can be used (more information on the methodology can be found here). The results indicate that global corn and rice production could each decline by ~2.3% from the 2021 production base, and wheat production could decline by 3.4% year-on-year. These projections may appear modest, but do not keep pace with rising global food requirements and smooth over regional diversions, including 5-10% production declines in Africa, Latin America ex. Brazil and Turkey.

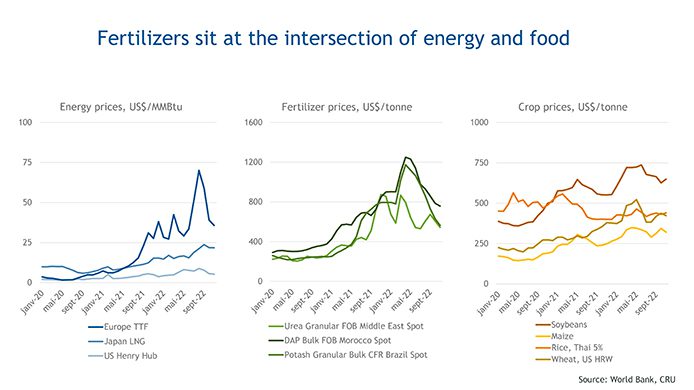

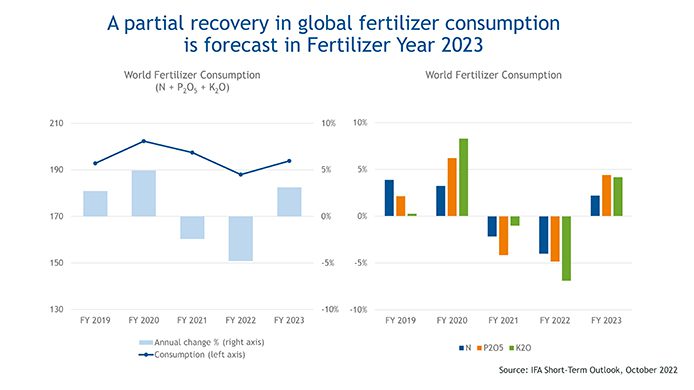

- Fertilizer availability concerns have transitioned to affordability concerns

The drivers impacting a farmers’ ability to use fertilizers have changed over the course of 2022. As outlined above, the direct and indirect impacts of sanctions on Russian and Belarusian raised initial fears that there would be a global fertilizer shortage, with a lack of product to meet demand requirements. However, as supply disruptions were somewhat alleviated, a new trend emerged, shifting availability concerns to affordability issues. In light of rapidly increasing prices in H1 2022, fertilizer consumers adjusted their buying patterns, delaying, reducing and in some cases skipping application on affordability grounds. This has been especially the case for phosphate and potash fertilizers.

A 5% decline in global fertilizer consumption is forecast in Fertilizer Year1 (FY) 2022, after a 2.4% decline in FY 2021 (from a higher base given strong demand in FY 2020). In two years, the combined drop would amount to 7%, close to the 8% fall experienced in FY 2008. In relative terms, N consumption is not expected to decline as much as consumption of P2O5 and K2O, as farmers prioritize N to preserve their crop yields and plant more acreage to less fertilizer intensive crops (namely soybeans).

After declining by 2% in FY 2021 and 5% in FY 2022, we forecast a 3% recovery in global fertilizer consumption in FY 2023 to 194 Mt of nutrients (+5.9 Mt), returning consumption to just above the FY 2019 level.

- The changing nature of the fertilizer industry investment cycle

Fertilizer production is capital intensive with high investment and ongoing maintenance costs. The CAPEX cost of a typical world scale greenfield ammonia-urea plant is around US$ 1.2 – 1.6 billion. Recent examples of integrated phosphate plants have a typical CAPEX of around US$ 1 billion, while potash mines take a significantly larger sum to bring a project into operation, with costs upwards of US$ 3 billion and some of the largest projects coming in at almost double that value.

Market volatility and geopolitical uncertainty has benefited some projects, and stalled others. At the same time, the industry’s sustainability goals have changed the pace and scale of new capacity announcements. In the nitrogen sector, with the promise of low-carbon ammonia technologies, there have been more than 50 green ammonia projects announced in the last two years. However, these have mostly been small-scale, amounting to 1.8 Mt of ammonia capacity currently under construction. More recently, several sizeable blue ammonia plants utilizing carbon capture and storage have been approved on the back of government initiatives, such as the US government’s Inflation Reduction Act.

Periods of high fertilizer prices usually stimulate investment in new capacity, but in previous waves of market driven project announcements, the sole criteria for financing a new project was its economics. Today, there is a far more nuanced business case, combining economics, geopolitics and environment, signaling a new era for fertilizer capacity investment.

What next for the fertilizer market?

Global commodity markets have been tested in 2022, and fertilizers are no exception. Our food systems are under stress, and it is likely that 2023 will remain disrupted compared to pre-2020 levels. But there are reasons to be optimistic, with humanitarian initiatives on food security gaining traction and sustainability remaining at the forefront of building further resilience in the fertilizer supply chain. One thing for sure is that the role of fertilizers in feeding the world sustainably has been highlighted like never before.

For more detailed commentary and the latest forecasts prepared by IFA’s Market Intelligence Service, please see our Short-Term Fertilizer Outlook 2022-23 here.

1Fertilizer Year: The reference period used to report fertilizer consumption varies depending on the country. Countries report fertilizer consumption statistics in 12-month periods that start either in January or in another month (most often April and July). The period “Fertilizer Year" (FY) refers to all 12-month periods. FY 2022 refers to the year starting in January 2022 for most countries in Latin America, Africa, East and Southeast Asia and EECA. For other regions including North America, WCE and South Asia, FY 2022 started in Q2 or mid-2022 and will end in Q2 or mid-2023.